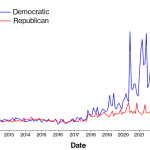

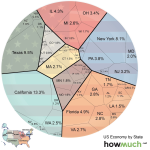

U.S. tariffs have become a focal point in recent discussions about trade and economics, particularly since their introduction under the Trump administration. These import taxes have not only drawn scrutiny from economists but have also sparked significant shifts in the global financial market. As countries navigate the economic impact of tariffs, the implications stretch beyond immediate revenue generation and hint at larger trade war implications. In the U.S., the debate continues over what constitutes an optimal tariff rate that balances national interests with global trade dynamics. With increasing complexity in international relations, understanding the nuances of tariff revenue and its overarching effects is crucial for policymakers and the public alike.

The discussion surrounding American import duties has gained traction in light of their profound influence on both domestic and international economic landscapes. These trade barriers, often referred to as import taxes, are not merely fiscal tools; they symbolize broader geopolitical strategies. As the economic ramifications of import tariffs unfold, it becomes essential to analyze their impact on global trade relations and financial markets. The consequences of these tariffs extend well beyond revenue, affecting the competitive landscape and prompting a reevaluation of trade policies. In this context, the concept of an optimal fiscal barrier emerges, guiding policymakers in their quest to balance domestic priorities with the realities of an interconnected global economy.

The Impact of U.S. Tariffs on Global Trade Dynamics

The recent implementation of U.S. tariffs has disrupted traditional trade dynamics, sending ripples through the global financial market. As economists like Oleg Itskhoki have noted, the effects of these tariffs extend beyond mere trade costs; they also influence currency valuations and investor confidence. The depreciation of the U.S. dollar following the tariff announcements serves as a stark reminder of how interconnected economies have become. With foreign exchange operations linked to import activities, the tariff strategy has inadvertently recommended a global reevaluation of trade agreements and partnerships.

Furthermore, the economic impact of tariffs is not limited to the U.S. alone. Other nations are now faced with the challenge of recalibrating their trade relationships, weighing the implications of retaliatory measures against potential benefits. The situation has heightened tensions, reminiscent of trade wars of the past, as countries evaluate strategic responses that align with their economic interests. Such shifts necessitate a reconsideration of how tariffs can be effectively managed in a global market characterized by rapid change and interdependence.

Frequently Asked Questions

What are the implications of recent U.S. tariffs on the global financial market?

Recent U.S. tariffs have caused significant fluctuations in the global financial market, impacting currency values, stock prices, and investor confidence. The increase in tariffs has led to a stronger U.S. dollar initially, as Americans purchase fewer imports, but this has also resulted in a depreciation of the dollar amid market instability and rising Treasury yields.

How does the concept of optimal tariff apply to current U.S. economic policies?

The concept of optimal tariff suggests there is an ideal import tax rate that benefits U.S. economic interests. Recent research indicates that the optimal tariff for the U.S. is likely below 10%, especially when considering financial market implications and the potential retaliatory actions from trading partners.

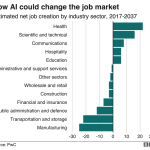

What is the economic impact of tariffs on U.S. manufacturing employment?

The economic impact of tariffs on U.S. manufacturing has been counterproductive; while tariffs were intended to protect domestic jobs, they often reduce the size of the tradable sector and could lead to further job losses in manufacturing. Subsidies targeting specific industries may be a more effective way to boost employment.

How do tariff revenues affect the U.S. economy during a trade war?

While the U.S. government does collect tariff revenues, these gains are minor compared to the larger economic ramifications of a trade war. The increased tax revenue from tariffs does not compensate for potential losses in investment or the U.S.’s standing in the global financial market.

Are there risks associated with the U.S. pursuing an optimal tariff strategy?

Yes, pursuing an optimal tariff strategy carries risks of retaliation from other countries, which can lead to a decline in international trade. This could exacerbate financial losses and harm the U.S.’s long-term position in the global financial market.

What role do tariffs play in the context of a trade war?

In the context of a trade war, tariffs serve as tools for imposing economic pressure on trading partners. However, they can also lead to increased tensions, decreased trade volumes, and higher prices for consumers, ultimately impacting economic stability.

How did market reactions to U.S. tariffs signal a shift in global economic dynamics?

Market reactions to U.S. tariffs have indicated a potential shift in global economic dynamics, with investors reassessing the risk of holding U.S. assets and the reliability of the U.S. dollar. This shift highlights concerns about the sustainability of American monetary policies amidst growing protectionism.

What should policymakers consider when evaluating U.S. tariffs?

Policymakers should consider both immediate tariff revenues and long-term economic consequences. Understanding the interplay between tariffs and the global financial market is essential to avoid detrimental effects on international trade relations and economic stability.

| Key Point | Details |

|---|---|

| Impact of U.S. Tariffs | President Trump’s tariffs initiated on April 2 caused significant global economic reactions leading to a financial meltdown. |

| Optimal Macro Tariff Concept | Economists are exploring the ‘optimal macro tariff,’ representing the best import tax rate for U.S. interests. |

| Historical Context | Prior to recent tariffs, the last global surge in tariffs occurred during the 1930s in response to the Great Depression. |

| Effects on U.S. Dollar | Typically, tariffs would strengthen the dollar; however, the recent tariff announcements led to a surprising dollar depreciation. |

| Tariff Revenue vs. Financial Market Stability | While the U.S. collects tariff revenue, the broader financial implications may destabilize its economic advantages as global investors seek alternatives. |

| Employment and Trade Balance | Higher tariffs may not improve U.S. manufacturing employment; instead, a targeted subsidy model is recommended. |

Summary

U.S. tariffs have triggered a significant transformation in the nation’s economic landscape, leading to unexpected financial repercussions and a reevaluation of trade policies. The recent tariff implementations, forecasted to safeguard U.S. interests, have instead sparked discussions about their long-term viability and impacts. As the financial market reacts to these tariffs, it’s clear that a strategic approach balancing both tariffs and subsidies might be essential in fostering sustainable U.S. economic growth and stability.