Credit score disparities are a troubling reflection of the socioeconomic landscape, revealing significant gaps influenced by race and upbringing. Recent research underscores how various factors, including socioeconomic class and geographic location, shape individuals’ credit scores, ultimately affecting their financial opportunities in adulthood. For example, a person raised in a financially literate environment is likely to develop better bill-paying habits, leading to higher credit scores, while those from disadvantaged backgrounds may struggle. These racial disparities in credit scores highlight the systemic issues that hinder upward mobility and access to essential resources like loans and housing. Understanding the roots of these disparities can pave the way for interventions aimed at enhancing financial literacy and improving credit outcomes for underserved communities.

The examination of inconsistencies in credit scoring has unveiled stark realities about the financial ecosystem in which individuals are raised. Known as credit score inequality, this phenomenon illustrates how different life situations, such as economic background and community resources, influence adult financial behaviors. Discrepancies in credit assessments reveal a broader picture of socioeconomic impacts on financial health and opportunities for advancement. Racial inequalities in credit assessments further complicate the narrative, as individuals of color often face additional barriers that contribute to their financial struggles. By analyzing how family dynamics and surrounding communities shape financial literacy and credit scores, we can better understand the challenges many face in achieving equitable financial standing.

Understanding Credit Score Disparities

Credit score disparities, as illuminated by recent research, reveal striking differences influenced by socioeconomic backgrounds and race. A study by Harvard’s Opportunity Insights shows that credit scores can tell a powerful story about an individual’s upbringing. For instance, those raised in lower-income families typically have lower credit scores compared to their peers from wealthier backgrounds. This disparity is not just a reflection of individual financial habits but also a systemic issue tied to socio-economic status, providing insights into how upbringing and community can affect financial behaviors later in life.

Moreover, the findings indicate that these disparities in credit scores are persistent over time. Individuals from wealthier families averaged a significant 725 at age 25, while those from lower-income households clocked in at 615. This 110-point gap suggests that early financial influences not only shape immediate credit behaviors but can also predict future financial success, thus perpetuating cycles of poverty or wealth across generations. Addressing these disparities is critical for any efforts aimed at promoting economic equity.

The Role of Socioeconomic Status in Credit Scores

Socioeconomic status significantly impacts credit scores and borrowing capabilities, underscoring the importance of financial literacy and its role in shaping responsible financial behaviors. Research indicates that upbringing in lower-income environments often leads to inadequate access to financial education, making it harder for these individuals to develop sound money management skills. These early interactions with money can set the tone for a lifetime of credit behaviors, causing those from affluent backgrounds to start with an advantage—both in knowledge and opportunities.

In addition to parental income, a child’s community often provides context for financial decision-making. Locations with high financial literacy rates typically result in better credit practices among residents. This implies that boosting financial education in underprivileged areas could have far-reaching effects on improving credit scores over time. By focusing on financial literacy, we can potentially bridge the gap created by socioeconomic divides, ensuring that everyone has an opportunity to improve their credit standing.

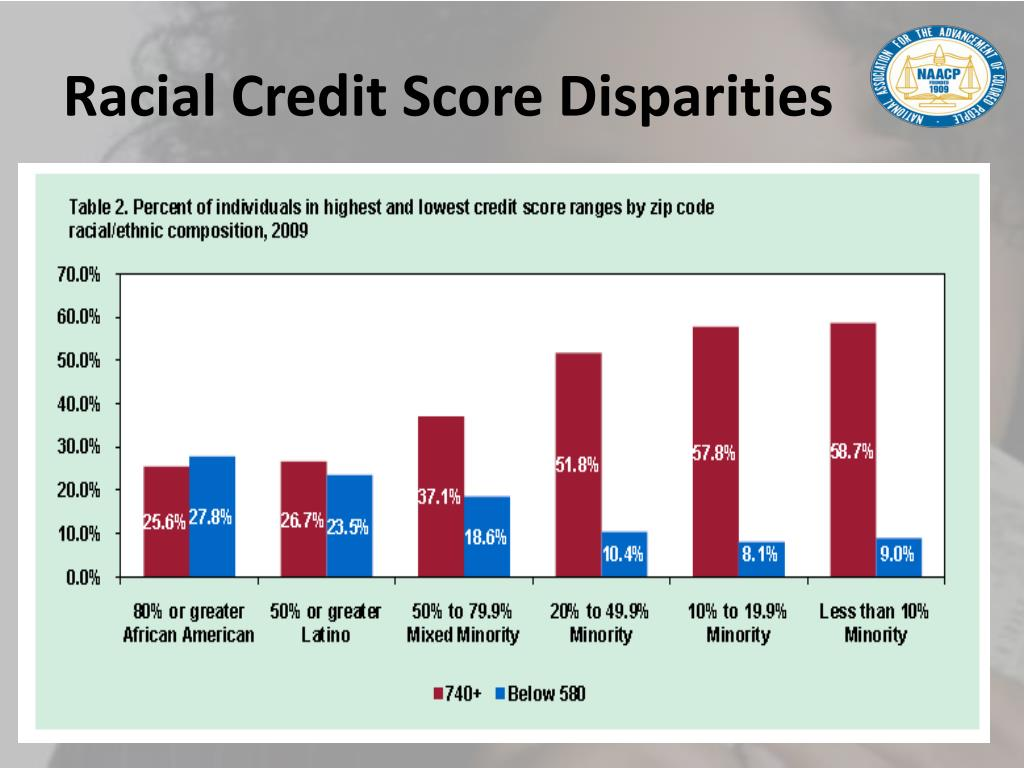

Racial Disparities and Their Impact on Credit Scores

The intersection of race and credit scores reveals pronounced disparities that cannot be overlooked. For example, Black Americans face credit scores nearly 100 points lower than their white counterparts, a situation that remains consistent over decades. This issue extends beyond mere numbers; it reflects broader systemic racial inequalities within financial institutions. Many Black individuals from low-income backgrounds encounter barriers to accessing traditional financial services, which only further exacerbates the cycle of credit disadvantage.

Additionally, the research demonstrates that even among those with similar parental income levels, racial discrepancies in credit scores persist. This stark reality calls for a multi-faceted approach to understanding credit score disparities that go beyond income or employment demographics. It is essential to explore how historical injustices and community-based financial practices contribute to these outcomes. Acknowledging and addressing these disparities will be paramount for achieving true economic equality.

The Influence of Upbringing on Financial Behavior

Upbringing plays a crucial role in shaping an individual’s financial behaviors, particularly regarding their credit scores. The research highlights how positive financial habits can be instilled in one’s formative years, ultimately influencing their adult repayment behaviors. For those raised in environments where discussing financial management was commonplace, it becomes easier to develop the necessary skills for maintaining a healthy credit score. Conversely, children exposed to financial instability may internalize negative credit behaviors, affecting their economic mobility.

Moreover, the findings indicate that relocation can modify one’s financial behaviors based on the community’s norms. For instance, individuals moving to a more financially literate area may adopt better financial habits, while those relocating to regions with poorer credit practices may struggle to adapt. This dynamic showcases the importance of establishing supportive financial environments where individuals can thrive and improve their creditworthiness over time.

Financial Literacy as a Key to Improving Credit Scores

Financial literacy emerges as a critical factor influencing credit scores, as individuals equipped with knowledge about managing credit are more likely to maintain high credit ratings. Understanding how credit works, including the effective usage of credit cards and repayment strategies, empowers individuals to make informed decisions that can enhance their financial status over a lifetime. Thus, increasing access to financial education is essential to bridging the gap in credit score disparities.

Moreover, educating communities about financial management can lead to meaningful change in credit behaviors over time. Programs that focus on teaching skills such as budgeting, saving, and debt management can play a significant role in equipping individuals with the tools necessary to improve their credit health. By prioritizing financial literacy initiatives, especially in underprivileged communities, we can effectively foster economic advancement and address the chronic disparities linked to credit scores.

Community Environment and Its Effect on Credit Scores

The community environment significantly influences credit behavior, with certain regions demonstrating higher average credit scores due to the local culture surrounding financial management. Areas with high levels of financial literacy and supportive resources often cultivate responsible credit habits, enabling residents to maintain excellent credit scores. Conversely, communities facing economic hardships may struggle with repayment behaviors, leading to lower average credit scores. This highlights the importance of community support and resources in fostering sound financial habits.

Furthermore, the geographic patterns revealed in the study pinpoint critical disparities in credit scores across different regions. For instance, residents of affluent areas like Bergen County, New Jersey, maintain some of the highest credit scores in the country, whereas cities like Baltimore show drastically lower averages. Understanding these community-level factors can help policymakers identify areas requiring targeted interventions, ultimately aiding in the creation of environments conducive to better credit practices.

The Long-Term Effects of Historical Economic Trauma on Credit Scores

Historical economic traumas, such as those stemming from discriminatory practices, have long-term effects on credit scores across generations. Research indicates that communities affected by events like the Tulsa Race Massacre continue to experience economic disadvantages, leading to a persistent decline in credit health. These events have systemic repercussions, as financial stability is often correlated with socio-historical contexts that influence present-day credit behavior and overall economic wellbeing.

Such long-term trends illustrate the need for a deep understanding of how historical injustices impact financial behaviors today. By addressing these historical contexts, we can better comprehend the ongoing challenges many communities face with credit scores and repayment behaviors. This awareness will be vital in developing targeted solutions aimed at rectifying these long-standing disparities in credit access and management.

Strategies for Enhancing Access to Credit

Enhancing access to credit requires a comprehensive approach that addresses the root causes of credit score disparities. It begins with improving financial literacy efforts targeting young individuals and their families. By equipping people with essential knowledge about credit, loans, and financial management, we can begin to dismantle the barriers that prevent many from accessing affordable credit options. Programs that integrate financial education into school curriculums can play a pivotal role in shaping healthier financial behaviors.

Moreover, advocating for changes in credit-scoring models to account for varied socioeconomic backgrounds would provide a more equitable assessment of creditworthiness. Creating alternative scoring mechanisms that consider non-traditional data, such as rental history and utility payments, could offer a lifeline for individuals usually disenfranchised in the current credit framework. These strategies, combined with community-driven initiatives, can help diminish credit disparities and pave the way for broader access to financial resources.

Advocacy for Policy Changes in Credit Scoring Systems

Policy changes in credit scoring systems are crucial for addressing disparities in credit scores arising from class, race, and geography. By advocating for more inclusive and representative metrics, we can ensure that credit reports reflect true financial behaviors rather than reinforcing existing prejudices. Legislative efforts to revise the Fair Credit Reporting Act to include alternative financial data can be a stepping stone towards a more equitable system.

Additionally, working with financial institutions to promote equitable access to credit for marginalized communities is essential. Financial literacy initiatives, accessible loan products, and community engagement programs can help mitigate the negative impact of historical inequalities on credit scores. Empowering individuals and fostering supportive environments through targeted policy changes will ultimately facilitate upward mobility and reduce disparities in credit access.

Frequently Asked Questions

What are the main factors contributing to credit score disparities among different racial groups?

Credit score disparities among racial groups can be largely attributed to socioeconomic factors, historical economic traumas, and the environments in which individuals are raised. Studies indicate that Black Americans, for instance, have average credit scores that are significantly lower than their white and Asian counterparts. This consistent trend showcases how early childhood experiences, financial literacy, and family financial backgrounds impact long-term credit behaviors.

How does socioeconomic status affect credit scores and disparities?

Socioeconomic status plays a crucial role in determining credit scores and disparities. Research shows that individuals from low-income families tend to have lower average credit scores compared to those from wealthier backgrounds. These disparities are often established by early adulthood and reflect differences in financial habits, access to financial education, and economic opportunities available within their communities.

In what ways does upbringing influence credit score development?

Upbringing significantly influences credit score development through a combination of financial education and parental financial behaviors. Children growing up in financially literate households are more likely to develop healthy bill-paying habits and maintain higher credit scores than those raised in environments that lack financial literacy. This illustrates how upbringing directly impacts future credit score disparities.

What role does financial literacy play in credit score disparities?

Financial literacy is a key factor affecting credit score disparities, as it equips individuals with the knowledge and skills needed to manage finances effectively. Those with higher financial literacy are generally better at budgeting, saving, and making informed credit decisions, leading to improved credit scores. Conversely, individuals lacking financial education may struggle with debt management, resulting in lower scores.

How do geographic factors contribute to racial disparities in credit scores?

Geographic factors contribute significantly to racial disparities in credit scores, as individuals from different regions often experience varying economic conditions and access to financial services. For instance, areas with strong economic stability show higher average credit scores compared to regions that face financial challenges. This reflects how community environments shape financial behaviors and consequently lead to disparate credit scores among racial groups.

What solutions could address credit score disparities in the U.S.?

Addressing credit score disparities requires a multifaceted approach, including improving financial literacy education, revising credit scoring methodologies to consider a broader range of factors beyond repayment history, and addressing systemic economic inequalities. Enhancing access to affordable financial services and creating community programs to educate individuals about credit management can also help mitigate these disparities.

Can moving to a different area change an individual’s credit score?

Yes, moving to a different area can influence an individual’s credit score. Individuals who relocate to communities with higher financial literacy and positive credit behaviors tend to adopt the beneficial financial practices of their new environment. However, the timing of the move matters; relocating at a young age fosters adaptation to new credit habits, while moving as a teenager may mean retaining behaviors from their original community.

What evidence supports the existence of credit score disparities across different regions in the U.S.?

Research by Harvard’s Opportunity Insights reveals stark regional credit score disparities, with certain areas like Bergen County, New Jersey, exhibiting high average scores, while others, such as Baltimore, show significantly lower scores. This evidence underlines the influence of community financial practices on individual credit behaviors and score outcomes.

| Key Points | Details |

|---|---|

| Influence of Environment | Credit scores are heavily influenced by the environment in which individuals are raised, including race, hometown, and socioeconomic class. |

| Parental Income Impact | A child’s credit score mirrors that of their parents. Individuals from the lowest income families average a score of 615 compared to 725 from wealthier backgrounds. |

| Racial Disparities | Black Americans have average credit scores 100 points lower than whites and 140 points lower than Asian Americans at age 25. |

| Geographic Disparities | Different regions show significant variations in credit scores, with areas like Bergen County, NJ having the highest scores, while cities like Baltimore demonstrate some of the lowest. |

| Job Stability’s Role | Racial disparities in repayment behavior persist even among individuals with similar job stability and income. |

| Need for Further Study | More research is necessary to understand how childhood environments impact financial management skills and eventual credit scores. |

Summary

Credit score disparities reveal significant differences rooted in childhood environments and socioeconomic backgrounds. Understanding these disparities is crucial as they impact not only financial opportunities but also ones’ socioeconomic advancement throughout life. The extensive research shows that upbringing greatly influences adult financial behavior, emphasizing the need for a deeper examination of how these factors affect repayment habits and financial success in diverse communities.