Stefanie Stantcheva, a prominent Harvard economist, has recently been awarded the prestigious John Bates Clark Medal, honoring her as one of the leading young economists under 40. Known for her groundbreaking tax policy insights, Stantcheva focuses on the intricate relationship between taxation and innovation. Her research emphasizes how well-structured tax systems can encourage economic behavior and foster cutting-edge inventions, making her work crucial in today’s economic landscape. During a celebratory event at Harvard, Stantcheva expressed gratitude for the recognition, highlighting the powerful role of tax policy in shaping an economy’s future. As the Nathaniel Ropes Professor of Political Economy, her contributions will continue to influence the fields of public finance and economic development for years to come.

In recognizing the significant accomplishments of Stefanie Stantcheva, the discussion around her contributions extends to the broader implications of tax systems on economic development. By examining public finance frameworks, economists aim to understand how different taxation strategies can either support innovation or hinder it. Stantcheva’s research not only sheds light on the immediate effects of tax changes but also explores long-term economic behaviors influenced by policy decisions. The intersection of taxation and innovation is becoming increasingly relevant, especially as economies navigate challenges like climate change and social mobility. Understanding these dynamics is essential for policymakers seeking effective reforms that stimulate economic growth.

Celebrating Stefanie Stantcheva: A Leading Economist Under 40

Stefanie Stantcheva, the Nathaniel Ropes Professor of Political Economy at Harvard, has made waves in the economics field with her groundbreaking work on tax policy and its implications for innovation and economic behavior. Awarded the prestigious John Bates Clark Medal, Stantcheva’s contributions highlight the essential role that effective tax policies play in fostering innovation. By analyzing the relationship between taxation and economic activity, she provides valuable insights that challenge traditional views of tax systems as mere revenue generators.

In her acceptance speech, Stantcheva acknowledged the impact that well-structured tax policies can have on an economy. Her assertion that taxation can motivate or impede innovation resonates with many economists and policy-makers. As more researchers look to her findings, it will be crucial for future tax policies to incorporate her insights to stimulate economic growth and innovation.

Understanding Tax Policy Insights from Stantcheva’s Research

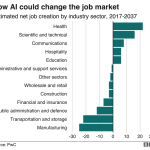

In her pivotal paper “Taxation and Innovation in the 20th Century,” Stefanie Stantcheva and her colleagues examined how different tax regimes influence innovation across various sectors. The research clearly indicates that economic behavior is highly responsive to tax policy, with elastic responses indicating that both entrepreneurs and established firms adjust their strategies based on their tax burdens. This elasticity demonstrates that optimal tax policy could significantly enhance innovation output, reinforcing the notion that tax structure matters.

Stantcheva’s work also reveals that while higher taxes may limit the quantity of new inventions, they do not necessarily affect the quality of these innovations. This nuanced understanding of taxes can help policymakers craft tax frameworks that maintain incentives for development while ensuring governmental support for social programs. It serves as a reminder that tax mechanisms need not be punitive but can be transformative when designed thoughtfully.

The Impact of Economic Behavior on Taxation

Economic behavior is intrinsically linked to the ways in which individuals and companies react to changing tax policies. Stantcheva’s research sheds light on this connection, indicating that well-informed policies can lead to increased innovation and productivity. By understanding how economic actors behave in relation to taxation, economists can better anticipate the outcomes of policy changes. Stantcheva emphasizes the necessity of integrating emotional considerations into economic models, suggesting that aspects like zero-sum thinking can greatly influence public perception and acceptance of tax policies.

Furthermore, the dynamic nature of economic behavior in response to tax law revisions underlines the need for ongoing research in this area. As tax policies evolve, they must be accompanied by a keen understanding of economic behavior patterns, which can fluctuate based on various socio-political factors. By continuing to investigate these relationships, future economists will be better equipped to offer innovative solutions that align tax systems with aspirational economic goals.

Innovation and Taxation: A Dual Challenge

Innovation and taxation often appear at odds in economic discussions; however, Stefanie Stantcheva’s groundbreaking studies suggest they can work harmoniously when managed effectively. Stantcheva argues that if tax policies are strategically designed to incentivize creative pursuits, they can mitigate the inherent risks that come with innovation. These insights are critical for policymakers aiming to boost economic growth within competitive landscapes.

The challenge lies in creating tax structures that stimulate creativity while still providing the necessary revenues for public services and infrastructure. Stantcheva advocates for a balanced approach, encouraging a thoughtful dialogue regarding how tax incentives can be aligned with long-term innovation goals. Such approaches will require a nuanced understanding of the economy’s multifaceted layers and careful consideration of how to uphold public trust in the tax system.

Support from Harvard: A Recognition of Excellence

The recognition of Stefanie Stantcheva by the American Economic Association through the John Bates Clark Medal is not only a personal achievement but also a testament to the thriving academic environment at Harvard University. Colleagues and mentors, such as Lawrence Katz and Elie Tamer, extol the caliber of work produced within the university, emphasizing the role of supportive institutions in nurturing leading economists. The collaborative spirit at Harvard allows for the exchange of ideas that push the boundaries of traditional economic thought.

As the academic community celebrates Stantcheva’s contributions, it also reinforces the importance of mentorship and professional networks in facilitating successful economic research. The collective effort from Harvard’s faculty to support pioneering work signifies a commitment to fostering an intellectual landscape where groundbreaking ideas like those of Stantcheva flourish, impacting not only the local economy but potentially inspiring global financial models.

The Future of Economic Research and Policy

Looking ahead, the work initiated by Stefanie Stantcheva promises to shape the future of economic research and policymaking, particularly in her Social Economics Lab. Her ongoing investigations into innovation, taxation, and social mobility aim to uncover pivotal insights that could redefine conventional economic strategies. By marrying rigorous academic research with real-world implications, Stantcheva exemplifies how economists can contribute meaningfully to societal advancement.

Moreover, the pursuit of answering complex economic questions through interdisciplinary approaches will be essential for future economists. Stantcheva’s exploration of the interplay between emotions and policies will likely lead to exciting new research avenues that delve into the psychological influences on economic choices. As economist communities across the globe become more interconnected, the collaborative exchange of knowledge will be fundamental in addressing the pressing challenges of modern economies.

Advancing Public Finance Understanding through Stantcheva’s Insights

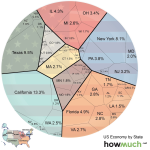

Stefanie Stantcheva’s research contributes significantly to the field of public finance, providing contemporary insights that emphasize the relationship between tax structures and economic activity. Public finance is crucial for supporting social welfare systems and fostering economic stability, and Stantcheva’s findings challenge policymakers to reconsider how taxes are structured to promote innovation while ensuring revenue collections.

The implications of her studies extend beyond theoretical frameworks, highlighting the need for practical applications that can guide effective public policy. As discussions around tax policy evolve, adhering to evidence-based approaches will become increasingly important in navigating complex economic landscapes and addressing societal needs.

The Role of Emotional Factors in Economic Decisions

Stefanie Stantcheva introduces a compelling dimension to economic research by considering the emotional aspects that play into financial decisions and policy acceptance. Her focus on zero-sum thinking exemplifies the critical intersection of psychology and economics, suggesting that how individuals perceive tax policies can significantly influence their overall economic behavior. Recognizing the emotional undercurrents driving public opinion on taxation can help economists craft better messages that resonate with the public.

Incorporating emotional intelligence into economic modeling can provide more comprehensive insights into consumer behavior, allowing economists to predict responses to tax changes more accurately. This innovative approach could lead to policies that not only address economic efficiency but also enhance public trust and compliance with tax regulations, ultimately fostering a healthier economic environment.

Future Economic Challenges: Insights from Stantcheva’s Work

As global economies face new challenges like climate change, immigration, and technological disruption, the relevance of Stefanie Stantcheva’s insights becomes increasingly critical. Her interdisciplinary approach allows for a more holistic understanding of economic issues, bridging gaps between traditional economic theories and contemporary challenges. By addressing how tax policy can be effectively leveraged to tackle these pressing issues, she opens the door for innovative solutions.

This expanded focus not only enriches the field of economics but also lays the groundwork for sustained economic resilience. As Stantcheva continues to lead research into how taxation can influence broader societal outcomes, her work remains vital in shaping policies that serve both economic and social objectives.

Frequently Asked Questions

Who is Stefanie Stantcheva and what is her significance in economics?

Stefanie Stantcheva is a renowned Harvard economist recognized for her pioneering insights on tax policy and innovation. As a recipient of the prestigious John Bates Clark Medal in 2025, she has made significant contributions to public finance and its effects on economic behavior.

What are Stefanie Stantcheva’s contributions to tax policy insights?

Stefanie Stantcheva’s contributions to tax policy insights include her groundbreaking research on how tax systems can impact economic innovation. Her work emphasizes that well-designed tax policies can encourage innovation, while poorly designed ones can hinder economic activity.

What did Stefanie Stantcheva discover in her 2022 paper on taxation and innovation?

In her 2022 paper titled “Taxation and Innovation in the 20th Century,” Stefanie Stantcheva and her co-authors found that innovation is highly responsive to changes in tax policy. They concluded that higher taxes negatively affect the quantity of innovation but do not diminish the quality of inventions.

What is the Social Economics Lab founded by Stefanie Stantcheva?

The Social Economics Lab, founded by Stefanie Stantcheva in 2018, focuses on understanding how individuals perceive economic issues and policies. The lab explores various topics, including the relationship between emotions and policies, and concepts like zero-sum thinking that influence economic behavior.

What accolades has Stefanie Stantcheva received as a Harvard economist?

As a prominent Harvard economist, Stefanie Stantcheva was awarded the 2025 John Bates Clark Medal for her outstanding contributions to the field, particularly in understanding tax policy and its impact on innovation and economic behavior.

How does Stefanie Stantcheva perceive the relationship between innovation and taxation?

Stefanie Stantcheva believes that the tax system plays a crucial role in fostering or stifling innovation. She asserts that a well-structured tax system can promote economic growth by incentivizing innovative activities.

What areas beyond taxation has Stefanie Stantcheva researched?

Beyond taxation, Stefanie Stantcheva’s research encompasses a variety of areas, including trade, immigration, climate change, and social mobility, reflecting her broad interest in how economic policies affect societal outcomes.

Why is the John Bates Clark Medal important in the field of economics?

The John Bates Clark Medal is an esteemed award given by the American Economic Association to under-40 economists who have made significant contributions to the field. Winning the medal signifies recognition of impactful research and thought leadership in economics, exemplified by economists like Stefanie Stantcheva.

| Key Points | Details |

|---|---|

| Award Received | Stefanie Stantcheva received the John Bates Clark Medal for significant contributions to economics. |

| Reason for Award | Recognized for pioneering insights on tax policy, innovation, and public finance. |

| Impact of Tax Policy | Stantcheva’s research shows tax policy greatly affects innovation behavior in the economy. |

| Research Topics | Explores trade, immigration, climate change, social mobility, and the effects of emotions on policies. |

Summary

Stefanie Stantcheva’s recognition with the prestigious John Bates Clark Medal marks a significant milestone in her career as a leading economist. This award not only highlights her innovative work in taxation and public finance but also underscores the vital relationship between tax policies and economic behavior. As she continues her groundbreaking research at the Social Economics Lab, Stefanie’s contributions are poised to advance our understanding of complex economic issues and ultimately influence policy making.