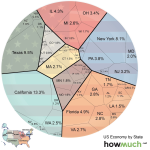

Research funding impact is a crucial element in shaping the landscape of innovation and entrepreneurship in the United States. With federal funding serving as a cornerstone for scientific and medical research, its disruptions signal potential setbacks not only to academic institutions but also to the broader startup ecosystem. Institutions like Harvard play a vital role in fostering entrepreneurship development, where advancements in lab research can catalyze groundbreaking startups. An infusion of capital into research directly correlates with economic growth, generating substantial returns on investment across sectors. As we explore the intricate relationship between funding, innovation, and economic vitality, it becomes evident that the future of U.S. innovation hinges on securing robust research support, especially in challenging times.

The repercussions of funding limitations on research initiatives significantly influence the entrepreneurial landscape and the overall economy. Academic institutions, particularly powerhouse universities like Harvard, serve as vital incubators for new ideas and ventures, profoundly affecting the startup sphere. When we examine the flow of resources into scientific exploration and its translation into commercial ventures, we recognize the intricate ties connecting education, innovation, and economic progress. The decline in federal support not only threatens the viability of emerging technologies but also stymies the ambitions of aspiring entrepreneurs who rely on these institutions for mentorship and capital. Ultimately, understanding the nuances of how these funding dynamics operate can illuminate the pathways through which innovation fosters resilience and growth in the economy.

The Role of Research Funding in Fostering Innovation

Research funding plays a pivotal role in fostering innovation within the startup ecosystem. Without substantial financial support, research projects struggle to progress from the lab to commercialization. Studies have shown that federal funding, specifically in the biomedical and scientific sectors, generates an impressive return on investment, catalyzing economic growth. For instance, every dollar spent on federal biomedical research yields $2.56 in economic activity, pointing to the undeniable link between funding and innovation.

Further, the infusion of funds not only aids in the development of groundbreaking technologies but also attracts top talents to research institutions. Universities like Harvard serve as incubators for entrepreneurial ideas, where research facilities and the academic environment provide a springboard for transformative startups. As these universities are equipped with state-of-the-art laboratories and facilities, the results foster a culture of innovation that benefits the broader economy.

Impact of Federal Funding on Economic Growth

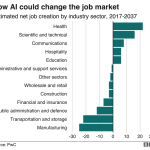

Federal funding is essential for nurturing the growth of tech and biomedical startups, significantly impacting U.S. economic growth. These funds promote advancements in research and development, which are crucial in keeping the country at the forefront of global innovation. The loss or freeze of such funding could pose serious threats to startups that rely heavily on research breakthroughs to create marketable products.

Moreover, economic analysis suggests that cuts to research funding may lead to a GDP contraction, echoing the financial strains witnessed during past economic downturns. The removal of research support destabilizes not only the institutions but also the network of startups that thrive on new scientific discoveries. As federal funding decreases, the entrepreneurial landscape may become less competitive and dynamic, hindering future innovations that drive economic expansion.

Potential Ripple Effects of Funding Cuts on the Startup Ecosystem and Entrepreneurship Development

The freeze on federal research funding has immediate and long-term repercussions for the startup ecosystem and entrepreneurship development. The creation of new companies is often a slow process, originating from years of research and development. Therefore, startups that might have been launched in the upcoming years may never see the light of day due to halted funding, causing a significant gap in innovation.

Furthermore, established startups often depend on cutting-edge research to refine and improve their products. A reduction in available federal research funding directly impacts these companies’ ability to innovate, which can stifle overall growth in the sector. As firms struggle to find new ideas and technologies, the landscape for entrepreneurship might stagnate, leading to fewer opportunities for aspiring innovators within the U.S. economy.

The Interconnection between Universities and the Startup Ecosystem

Research universities are incredibly influential in bridging the gap between academic research and the startup ecosystem. The commercialization of research is often driven by faculty who bring their discoveries out of the lab and into the marketplace. At Harvard, the cultivation of ideas through affiliations with venture capitalists and the presence of accelerators are instrumental in promoting entrepreneurship among students and graduates.

The strength of this interconnected system is in its ability to produce a steady stream of innovative startups. With a curriculum designed to foster entrepreneurial thinking, universities not only impart knowledge but also encourage the practical application of ideas within real-world contexts. This symbiotic relationship supports a vibrant ecosystem that keeps the U.S. at the leading edge of technological advancements, driven by the energy and creativity of young entrepreneurs.

Understanding the Role of Entrepreneurship in Economic Recovery

As the economy seeks recovery, entrepreneurship emerges as a critical component to revitalizing growth. Startups are known for creating new jobs and driving innovation, which are essential for bouncing back from economic downturns. An encouraging environment for entrepreneurs fosters a culture of creativity and risk-taking, allowing for the emergence of cutting-edge companies ready to tackle global challenges.

Furthermore, entrepreneurship spurs competition and prompts established companies to innovate, ultimately benefiting consumers through a wider range of products and services. Strengthening support networks, including federal funding for research and development, can significantly bolster entrepreneurial activity, creating a more resilient economy capable of weathering future challenges.

Funding Freeze and Its Long-term Consequences on Entrepreneurship

The freezing of federal funding for research poses troubling long-term consequences for the entrepreneurial landscape. As universities suspend research projects due to funding uncertainty, the incubation of ideas that could transform into startups is hindered. This period of stagnation threatens not just the budding entrepreneurs of today, but the potential technological advancements that could have driven economic growth in the future.

Moreover, a decline in successful startup formation due to funding cuts can lead to brain drain, where talented individuals seek opportunities overseas. This not only diminishes local entrepreneurial spirit but also negatively impacts the domestic economy as fewer innovations emerge from U.S. research institutions. It is critical to recognize that what affects funding at universities reverberates throughout the broader ecosystem, culminating in a less vibrant entrepreneurial environment.

The Essential Connection Between Research and Commercialization

The pathway from research to commercialization is a complex yet vital process. Federal funding not only supports the initial stages of research but also lays the groundwork for the successful translation of ideas into viable products. This process often entails collaboration between researchers and entrepreneurial minds, showcasing how essential research universities are in nurturing innovation.

Universities such as Harvard play a critical role by providing valuable resources and mentorship for aspiring entrepreneurs. Students and faculty are often encouraged to collaborate, leading to the formation of startups that leverage cutting-edge research. However, disruptions to the funding pipeline could sever these partnerships, leaving many potentially groundbreaking ideas without the necessary support for development and commercialization.

How Research Universities Cultivate Future Entrepreneurs

Research universities serve as the breeding grounds for future entrepreneurs by offering robust programs and resources to students eager to start their ventures. Through hands-on experiences, mentorships, and networking opportunities, these institutions equip aspiring business leaders with the skills needed to navigate the complex startup landscape. Harvard, in particular, emphasizes an entrepreneurial curriculum that positions its students to launch successful companies.

Additionally, the supportive environment within research universities nurtures creativity and innovation, empowering students to transform academic insights into business objectives. By collaborating with seasoned entrepreneurs and industry experts, students gain practical knowledge that fosters confidence in pursuing their entrepreneurial aspirations, creating a cycle of innovation that benefits the economy.

Federal Funding as a Catalyst for Breakthrough Innovations

Federal funding is often described as a catalyst for breakthrough innovations within the startup ecosystem. This essential financial support enables researchers to push the boundaries of science, often leading to pioneering discoveries with the potential to drive economic growth. Not surprisingly, many of today’s leading tech companies have roots tracing back to federally funded research initiatives.

The presence of federal funds creates a ripple effect that enhances academic institutions’ reputation as incubators for talent and innovation. Such funding attracts some of the brightest minds, which in turn generates a vibrant ecosystem of startups that contribute to job creation and economic performance. As the landscape evolves, maintaining this funding is crucial to safeguarding a future rich in entrepreneurial endeavors.

Frequently Asked Questions

What is the impact of research funding on the startup ecosystem?

Research funding is crucial for the startup ecosystem as it provides the financial resources necessary for innovation and technological development. Startups often emerge from groundbreaking research conducted in universities, where faculty and students collaborate to transform scientific discoveries into viable commercial applications. Without adequate research funding, the pipeline for new startups diminishes, hindering economic growth.

How does federal funding affect entrepreneurship development in technology sectors?

Federal funding plays a vital role in entrepreneurship development, particularly in technology sectors. It supports the establishment of research labs that foster innovation, enabling entrepreneurs to access cutting-edge ideas and resources. This support leads to a thriving entrepreneurial landscape where startups can leverage federally funded research to create new products and services, ultimately contributing to economic growth.

What role do research universities play in fostering economic growth through innovation?

Research universities serve as incubators for economic growth by bridging the gap between academic research and the startup ecosystem. They provide resources, mentorship, and a collaborative environment that encourages students and faculty to commercialize their research. This promotes innovation, leading to the establishment of new startups that contribute to economic expansion and job creation.

What are the consequences of cuts to federal funding on Harvard research initiatives?

Cuts to federal funding significantly impact Harvard’s research initiatives by limiting the resources available for scientific exploration and innovation. This can lead to a decrease in groundbreaking discoveries and subsequently fewer startups emerging from the university. The long-term effect may include a slowdown in economic growth as the flow of new ideas and technologies is stifled.

How important is research funding for biomedical innovation and startups?

Research funding is critically important for biomedical innovation, as it supports the development and testing of new treatments and technologies. Startups in the biomedical field rely on this funding to bring innovative solutions to market. The economic impact of such funding is substantial, as it generates significant economic activity for every dollar invested, further indicating its importance for entrepreneurship and economic growth.

What impact does the current funding freeze have on the future of entrepreneurship?

The current funding freeze is projected to have a medium to long-term impact on entrepreneurship, particularly in the startup ecosystem. As research initiatives are halted, fewer promising startups will emerge from the innovation pipeline. This could lead to a depletion of new ideas and technologies that drive economic growth, emphasizing the critical nature of sustained funding.

Can the effects of disrupted research funding on the startup ecosystem be reversed?

Yes, the effects of disrupted research funding can potentially be reversed, but recovery will take time. The transition from lab research to commercially viable startups typically spans one to three years. Reinstating funding and support mechanisms can help rejuvenate the startup ecosystem and stimulate economic growth, but it requires a concerted effort to restore the innovation pipeline.

| Key Point | Details |

|---|---|

| Research Funding Cuts | The Trump administration froze $2 billion in grants at Harvard, totaling over $9 billion targeted for review. |

| Impact on GDP | Expected GDP shrinkage by 3.8%, comparable to the 2008-2009 recession. |

| Role of Startups | Startups drive innovation and bring scientific breakthroughs to market. |

| Pathways to Startup Ecosystem | Faculty and students serve as bridges to commercialization, especially in labs. |

| Importance of Federal Funding | Critical for lab resources, attracting talent, and fostering economic growth. |

| Long-Term Effects of Freezes | Immediate effects not seen yet; damage could take 1-3 years to manifest. |

Summary

Research funding impact is critical to the future of U.S. innovation and economic growth. Cuts to research funding not only threaten the operations of prestigious institutions like Harvard but also disrupt the entrepreneurial ecosystem that relies on robust research activities. The potential ramifications include stunted growth in the startup sector, which is essential for translating scientific discoveries into marketable solutions. Past experiences show that disruptions in funding create long-term challenges in fostering innovative companies, emphasizing the urgent need to ensure stable research investment for sustained economic health.