The potential for Trump Fed Chairman removal has sparked intense debate among economists and political analysts alike. President Trump’s tumultuous relationship with Jerome Powell, the Federal Reserve Chair appointed in 2017, raises questions about the impact of such a move on the economy and financial markets. Trump has consistently criticized Powell for not aligning monetary policy with his vision, particularly regarding interest rates. The notion of ousting Powell, however, could undermine Federal Reserve independence and lead to significant market reaction, as observers fear a shift towards looser monetary policies. With inflation concerns looming large, the implications of Trump’s threats to remove Powell could reverberate through the economy, highlighting the crucial balance between political influence and the Fed’s commitment to stability.

The discussion surrounding the possible dismissal of the Federal Reserve Chairman by President Trump is indicative of larger tensions within U.S. economic policy. Jerome Powell, who has been at the helm since 2017, has found himself at odds with Trump’s monetary strategies, leading to speculations about the president’s authority over the independent institution. The crux of the issue lies in whether a president can exert such power without compromising the foundational principle of Federal Reserve autonomy. Analysts caution that any attempt to replace Powell could trigger a volatile market reaction, fueled by fears of a deviation from established interest rate norms. Ultimately, this situation underscores the intricate relationship between executive power and central bank independence as it pertains to both short-term economic growth and long-term financial health.

The Authority of the President in Federal Reserve Appointments

The question of whether President Trump can effectively fire Federal Reserve Chairman Jerome Powell centers on the nuances of the Federal Reserve Act and the interpretation of executive power within independent agencies. Under the current legal framework, the act permits the removal of governors for ’cause,’ but it remains ambiguous whether this provision extends to the chairperson. Legal scholars argue that the recent interpretations of constitutional authority could allow for greater presidential control over such appointments. The implications of this potential shift could drastically alter the dynamic of monetary policy in the United States.

Historically, the Federal Reserve operates with a degree of independence from political pressures to maintain market confidence and fight inflation. If Trump were to pursue the removal of Powell, it might set a precedent that could undermine the established independence of the Fed. Economic advisors within the administration would likely caution against such a move, recognizing that a significant shift in leadership could incite fears of instability in markets. Thus, the conflict reflects the broader debate about the balance of power between federal agencies and the executive.

Market Reactions to Potential Changes in the Federal Reserve Leadership

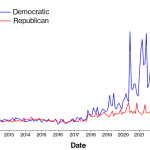

The prospect of removing Fed Chairman Powell invokes significant market anxiety due to the potential implications for monetary policy. Investors typically react strongly to changes within the Federal Reserve, as they view the institution as a stabilizing force for the economy. Should Trump attempt to oust Powell, analysts predict that markets could respond negatively, driving interest rates higher as confidence in the Fed’s independence and credibility diminishes. This reaction is rooted in a fear that political motivations might influence monetary policy, leading to decisions that could exacerbate inflation rather than curb it.

Moreover, during times of economic uncertainty, markets often favor consistency and reliability in Fed leadership. A swift removal of Powell would likely signal a shift towards a more interventionist monetary policy, contrary to the Fed’s existing inflation targets. Such a shift could result in increased volatility in the stock market, as investors reassess their long-term strategies. To maintain economic stability, the administration may want to avoid such drastic measures and allow Powell to fulfill his term, at least until a more favorable time for a leadership change.

Frequently Asked Questions

Can Trump legally remove the Fed chairman Jerome Powell?

Yes, while President Trump can technically remove the Federal Reserve chairman Jerome Powell, the legality of this action is complex. The Federal Reserve Act allows for removal ‘for cause,’ but the interpretation of this clause is debated. Any move to fire Powell could impact the Fed’s independence and likely provoke significant market reaction.

What would happen if Trump decided to remove Jerome Powell as Fed chairman?

If Trump were to remove Jerome Powell as Fed chairman, it could lead to major market instability. Such a move may signal a shift towards a more accommodative monetary policy, potentially undermining investors’ trust in the Federal Reserve’s independence and leading to spikes in long-term interest rates.

How might market reaction differ if Trump fired Jerome Powell?

Market reaction to Trump firing Jerome Powell could be severe. Traders may perceive this action as the politicization of monetary policy, leading to fears of inflation and a lack of confidence in the Fed’s ability to control interest rates, causing stock prices to drop and long-term treasury yields to rise.

Is there precedent for a president removing a Fed chairman like Powell?

Historically, the independence of the Federal Reserve has been upheld, and no president has removed a chairman without significant cause. The case of Jerome Powell could set a new precedent, depending on how the courts interpret executive removal power and the Fed’s established autonomy.

What impact would Trump replacing Powell with a new Fed chairman have?

If Trump were to replace Powell with a new Fed chairman, it would depend on the successor’s monetary policy stance. Markets would closely monitor the replacement, as a perceived shift towards more aggressive rate cuts could reassure some investors but alarm others concerned about inflation.

How does Trump’s monetary policy influence the Federal Reserve’s decisions under Powell?

Trump’s monetary policy has notably influenced the Federal Reserve’s decisions, particularly regarding interest rates. Powell’s reluctance to lower rates in response to Trump’s calls for more aggressive cuts illustrates the tension between an independent Fed and political pressures, impacting market perceptions and stability.

What arguments exist against Trump removing Chairman Powell?

Arguments against Trump removing Chairman Powell include the respect for Federal Reserve independence, the potential negative market reaction, and legal uncertainties surrounding removal powers. Analysts suggest that removing Powell could hurt the Fed’s credibility and effectiveness in managing inflation and economic stability.

What role does public perception play in Trump’s potential removal of Fed chairman Powell?

Public perception plays a crucial role in any discussions about removing Fed chairman Powell. Analysts believe that if the public views the move as undermining the Fed’s independence, it could lead to significant market instability and lower trust in monetary policy, complicating economic recovery efforts.

Would the Supreme Court support Trump’s decision to fire Powell?

It’s uncertain whether the Supreme Court would support Trump’s decision to fire Powell. Recent rulings have questioned the independence of regulatory agencies, but whether the justices would apply the same reasoning to the Federal Reserve remains to be seen, creating potential legal risks for any dismissal.

How has Jerome Powell’s stance on interest rates affected Trump’s monetary policy agenda?

Jerome Powell’s cautious approach to interest rate changes has often clashed with Trump’s monetary policy agenda, which favors aggressive cuts to stimulate the economy. This discord highlights the challenges facing the Fed as it navigates political pressures while attempting to maintain economic stability.

| Key Issues | Details |

|---|---|

| Trump’s Authority | President Trump has hinted at the possibility of firing Fed Chair Jerome Powell, raising concerns about the independence of the Fed. |

| Risk to Market Stability | Market analysts warn that firing Powell could harm the Fed’s credibility and lead to significant market instability. |

| Legal Interpretation | There is ambiguity in the Federal Reserve Act regarding whether the President can remove the Chair without cause. |

| Supreme Court’s Role | The Supreme Court may affect the President’s ability to remove the Chair based on interpretations of executive authority. |

| Impact of Fed Decisions | The Fed’s independence is critical to maintaining inflation targets; removal of the Chair could shift monetary policy towards immediate growth. |

| Market Expectations | Investors fear increased inflation risk if Powell is replaced, potentially leading to higher long-term interest rates. |

Summary

Trump Fed Chairman Removal is a contentious issue that raises critical questions about the independence of the Federal Reserve. While President Trump has publicly contemplated removing Federal Reserve Chair Jerome Powell, analysts caution that such a move could destabilize markets and undermine the Fed’s credibility. Significant legal and constitutional ambiguities surround the President’s authority to remove a Fed Chair, and the Supreme Court’s potential interpretations of this power could redefine the boundaries of executive authority. Overall, the stability of the financial markets during Trump’s presidency may hinge on this pivotal decision, underscoring the impact of leadership changes on governmental monetary policy.