Stefanie Stantcheva, a distinguished Harvard economist, has recently been honored with the prestigious John Bates Clark Medal for her groundbreaking contributions to economic theory. As a leading voice in public finance, Stantcheva has focused her research on vital areas such as tax policy and economic innovation, unraveling the complexities that affect both individual behavior and collective growth. Her pioneering insights challenge conventional notions and emphasize the crucial role that tax systems play in fostering or hampering economic activity. During her acceptance speech, Stantcheva articulated her passion for understanding how well-designed tax frameworks can stimulate innovation and drive progress. Her work not only elevates the discourse in economic circles but also has implications that can shape future policies for sustainable development.

In the realm of economics, the work of Stefanie Stantcheva serves as a significant beacon of thought, especially concerning fiscal systems and their broader implications. Awarded the John Bates Clark Medal, she stands out as a Harvard academic who has skillfully navigated complexities in public finance, bringing fresh perspectives to the discussion of taxation and its effects on economic creativity. Stantcheva’s research sheds light on how fluctuating policies can either promote or inhibit innovation, a topic increasingly relevant in today’s economy. As the founder of the Social Economics Lab, she seeks to address pressing economic issues, including migration trends, climate impacts, and social mobility. With her comprehensive approach, Stantcheva is paving the way for a better understanding of the interaction between tax structures and societal advancement.

Stefanie Stantcheva: A Rising Star in Economics

Stefanie Stantcheva is making waves in the economic community, particularly as she receives the prestigious John Bates Clark Medal, awarded to an economist under the age of 40 whose work has significantly affected the field. Known for her innovative research, Stantcheva’s insights into tax policy and public finance have garnered the attention of fellow economists and policymakers alike. Her dedication to exploring how taxation influences economic behavior positions her uniquely in today’s discussions around economic innovation and fiscal policy.

In her role as the Nathaniel Ropes Professor of Political Economy at Harvard, Stantcheva challenges conventional views on taxation and its interplay with innovation. Her work has illuminated the critical ways in which tax systems can either stimulate or hinder economic growth. This dynamic is especially relevant in a world increasingly focused on sustainable economic practices and accountable fiscal responsibility.

Understanding Tax Policy Through Economic Innovation

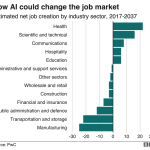

Tax policy is not merely a tool for revenue generation; it fundamentally shapes the landscape of economic innovation. Stefanie Stantcheva’s groundbreaking research highlights how alterations in taxation can directly affect the rate and quality of innovation in various sectors. In 2, her paper titled “Taxation and Innovation in the 20th Century” showcased that while higher taxes tend to diminish the sheer volume of innovations, they do not necessarily compromise the quality of these inventions, thereby inviting a reevaluation of how tax structures are designed.

This relationship between taxation and innovation underscores the importance of well-crafted tax policies that motivate creativity and development, particularly in rapidly evolving industries. By focusing on public finance, Stantcheva emphasizes the role of strategic governance in promoting economic activity, thereby inspiring lawmakers to rethink existing tax regulations and their intended outcomes.

The Impact of Public Finance on Economic Behavior

Public finance is a critical component of economic theory and practice, affecting not just how governments function, but also how individuals and businesses respond to fiscal policies. Stantcheva’s insights reveal that tax policies influence individual and corporate decisions – from investment strategies to hiring practices. By demonstrating the elasticity of innovation in relation to tax changes, she sheds light on the importance of tax incentives in fostering an environment conducive to economic growth.

Furthermore, the implications of her work extend beyond mere statistics; they resonate within everyday economic experiences. An effectively structured tax system has the potential to promote entrepreneurial ventures and technological advancements, which are pivotal in today’s competitive global market. Stantcheva advocates for a comprehensive understanding of these dynamics to ensure that economic policies align with the broader goals of innovation and growth.

Stefanie Stantcheva and the Future of Economic Research

As a prominent figure at the forefront of economic research, Stefanie Stantcheva’s future work promises to further bridge the gap between theoretical economics and practical applications. The foundation of her research lies in understanding the complexities of economic behavior, particularly how emotions and societal perceptions influence policy outcomes. Her Social Economics Lab leading these inquiries into policy’s psychological underpinnings signifies a pivotal shift towards a more holistic approach to economics.

In a rapidly changing economic landscape, Stantcheva’s focus on issues like trade, immigration, and climate change reflects an awareness of the multifaceted nature of public finance. Such interplay between diverse economic factors and societal needs is essential for developing responsive policies that cater to modern challenges. Her innovative lens is expected to yield actionable insights that not only enhance academic discourse but also inform policymakers as they strive to create equitable and effective economic frameworks.

The Relevance of the John Bates Clark Medal in Economics

The John Bates Clark Medal is revered in the field of economics, symbolizing excellence in research and the promise of impactful contributions to the discipline. Being a recipient at such a young age signifies not just remarkable achievements but also sets a precedent for future economists. Stantcheva’s award underlines the importance of fostering innovative ideas in economics, particularly regarding public finance and the role of tax policy in economic systems.

Receiving this medal places Stantcheva among a distinguished group of economists who have shaped the trajectory of economic thought. It highlights the imperative for young researchers to engage with pressing economic issues and encourages them to create solutions that can drive meaningful change in society. The recognition of her work underscores the changing narrative in economics, where new voices and ideas are increasingly acknowledged and celebrated.

Exploring Economic Mobility Through Public Finance

Economic mobility is a persistent concern in contemporary society, and understanding its connection to public finance is crucial for formulating effective policies. Stantcheva’s research delves into how taxation can either facilitate or obstruct upward mobility. By scrutinizing the nuances of tax policy, she advocates for reforms that enhance opportunities for marginalized communities, thereby addressing systemic inequalities that have persisted over generations.

The implications of her findings are far-reaching, emphasizing that a well-structured public finance system is fundamental in providing equitable access to resources and opportunities. Policymakers must take into account how different tax policies impact various demographic groups to craft initiatives that truly uplift all sectors of society, promoting economic fairness and resilience.

The Role of Economic Education in Public Policy

Economic education is vital for informed public policy formulation. Stantcheva’s contributions highlight that a more profound understanding of economics among policymakers can lead to more effective and rational tax policies. By educating future economists and policymakers through her research and the establishment of the Social Economics Lab, she aims to cultivate a generation that can critically assess the implications of public finance on diverse populations.

This focus on education paves the way for greater civic engagement as citizens become more aware of how tax systems affect their lives. It also emphasizes the importance of integrating economic theories into mainstream discussions about social issues, ensuring that policies reflect both economic realities and social priorities. Stantcheva’s approach illustrates that comprehensive understanding can lead to more equitable and innovative economic solutions.

Advancing Conversations on Climate Change and Public Finance

Stefanie Stantcheva’s research extends to pressing global issues such as climate change, illustrating the intersection of environmental considerations and public finance. As policymakers grapple with the urgency of addressing climate change, understanding the implications of tax policy on environmental innovation is essential. Her work encourages a reevaluation of fiscal strategies to include incentives for green technology and sustainable practices.

By crafting tax policies that support environmental objectives, governments can drive significant investment into clean energy solutions while simultaneously promoting economic growth. This dual focus on sustainability and economic advancement is vital in today’s context, where the impacts of climate change demand immediate and effective action. Stantcheva’s contributions foster meaningful dialogue on how public finance can align with ecological preservation initiatives.

The Intersection of Taxation, Innovation, and Economic Growth

At the heart of modern economic discussions lies the interplay between taxation, innovation, and growth. Stantcheva’s exploration of this relationship raises critical questions regarding how tax structures can be optimized to foster a dynamic business environment. Understanding the elasticity of innovation in response to tax changes gives policymakers valuable insights into designing effective tax regimes.

This intersection suggests that fostering an innovative economy requires more than mere funding; it necessitates intelligent tax policies that stimulate research and development activities. Stantcheva’s research emphasizes that a thoughtful approach to taxation can lead to enhanced economic performance and substantial advancements in technology, ensuring that economies not only grow, but thrive.

Frequently Asked Questions

Who is Stefanie Stantcheva and why is she notable in the field of economics?

Stefanie Stantcheva is a prominent Harvard economist recognized for her groundbreaking research in public finance, tax policy, and economic innovation. She was awarded the John Bates Clark Medal in 2025 for her significant contributions, particularly in understanding how tax policy influences innovation and economic behavior.

What does Stefanie Stantcheva’s research on tax policy reveal about its effects on the economy?

Stefanie Stantcheva’s research indicates that tax policy plays a crucial role in shaping economic innovation. Her studies show that higher taxes can deter the quantity of innovations, although they do not necessarily affect the quality of inventions. This highlights the importance of designing tax systems that encourage economic activity.

What is the significance of the John Bates Clark Medal awarded to Stefanie Stantcheva?

The John Bates Clark Medal is a prestigious award bestowed by the American Economic Association to an economist under 40 who has made significant contributions to the field. Stefanie Stantcheva’s receipt of this medal in 2025 underscores her impact on public finance and tax policy, acknowledging her work in advancing economic innovation.

How has Stefanie Stantcheva influenced public finance discussions in her career?

Stefanie Stantcheva has influenced public finance discussions through her innovative research that intertwines tax policy with economic behavior and innovation. Her work has provided new insights into how tax systems can be structured to positively affect economic growth, making her a key figure in contemporary economic debates.

What are some of the key topics explored by Stefanie Stantcheva in her academic work?

Stefanie Stantcheva’s recent academic work has explored diverse topics, including public finance, tax policy, economic innovation, trade, immigration, climate change, and social mobility. Her findings aim to bridge the gap between economic theory and real-world policy implications.

What role does the Social Economics Lab, founded by Stefanie Stantcheva, play in economic research?

The Social Economics Lab, founded by Stefanie Stantcheva in 2018, conducts research to understand how individuals perceive economic issues and policies. The lab focuses on innovative topics such as the relationship between emotions and economic policy, which contributes to a deeper understanding of public attitudes toward economic governance.

How does Stefanie Stantcheva’s research address the interplay between tax policy and innovation?

Stefanie Stantcheva’s research demonstrates a high elasticity of innovation in response to changes in tax policy. Her studies suggest that well-designed tax systems can promote innovation, while poorly structured tax policies may hinder economic activity, emphasizing the need for effective tax strategies to spur growth.

| Key Point | Details |

|---|---|

| Award Recognition | Stefanie Stantcheva won the 2025 John Bates Clark Medal from the American Economic Association. |

| Field of Expertise | Stantcheva is recognized for her pioneering work in tax policy, innovation, and economic behavior. |

| Significance of the Award | The Clark Medal is awarded to a leading economist under 40, highlighting significant contributions to economics. |

| Impact of Tax Policy | Her research indicates that tax policy significantly influences innovation—higher taxes can negatively impact the quantity of innovation. |

| Social Economics Lab | Stantcheva founded the Social Economics Lab, focusing on issues like trade, immigration, and climate change. |

Summary

Stefanie Stantcheva’s recent recognition with the John Bates Clark Medal underscores her significant impact in the field of economics, particularly in tax policy and innovation. Her research demonstrates how tax systems can shape economic behavior, highlighting her vital contributions. Stantcheva continues to lead innovative projects at the Social Economics Lab, where she explores complex issues in economics and their societal implications.